What we offer

Your business relies on the skills and talents of its employees, so you'll want to make sure they are rewarded, motivated, and protected.

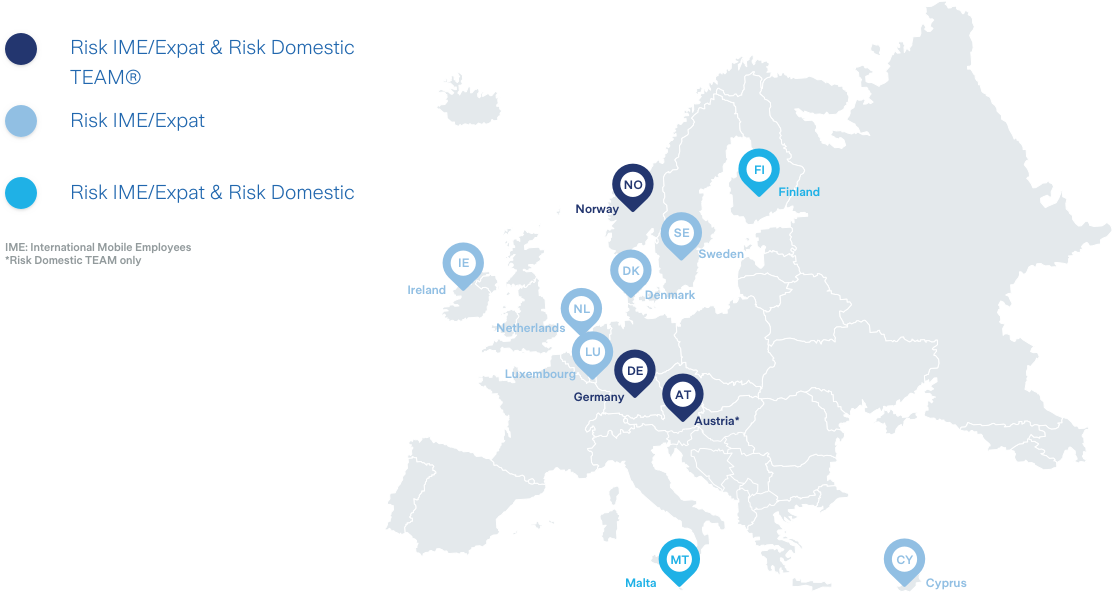

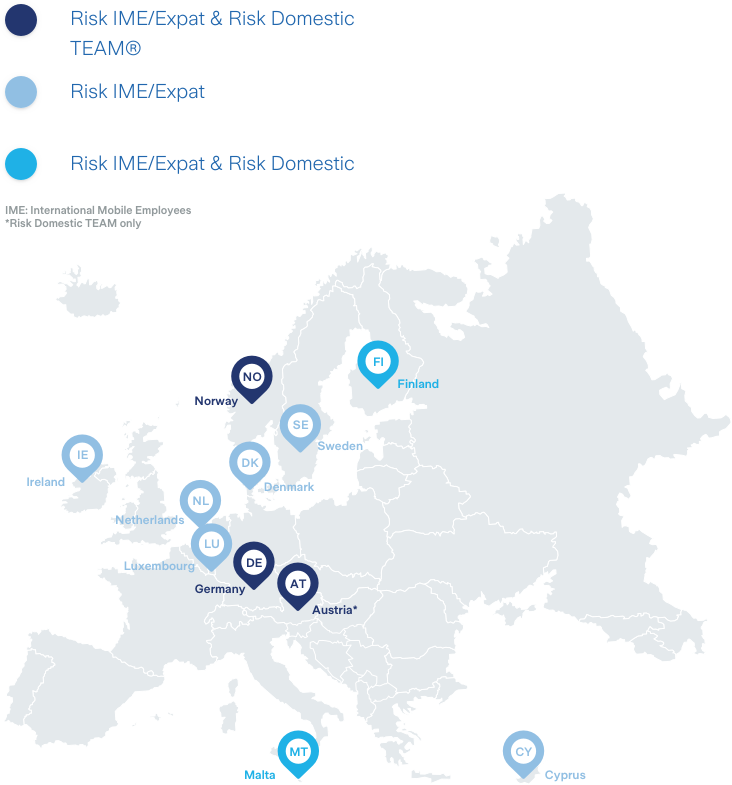

Serving multinational and regional businesses in 11 European countries providing corporate employee benefits solutions: Risk Group life and disability cover for 245,000 employees, domestic and international mobile as well as expats.

With our group life and disability cover, we can help you to find appropriate solutions that will take care of your employees.

Be the business that protects its people.

If we’ve learnt anything recently, it’s that life has a habit of hitting us with the unexpected. We’ve made it easy and affordable to provide your people with Group Life and Income Protection.

Protection for your people when they really, really need it.

Which country,

which products?

Local Solution: Team Existence

Assurance Model

TEAM® is an innovative group solution for the German, the Austrian and the Norway domestics markets that helps you to protect your valuable employees against the financial impact of death and disability.

EXPATS: Zurich International Group Risk Solutions

Zurich International Group Risk Solutions (ZIGRS) provides you with group life, disability and income protection for your internationally mobile employees.

Learn more about ZIGRS Solutions

Why do companies choose to

work with us?

Key benefits

Product Oversight and Governance

As a result of the Insurance Distribution Directive (IDD) Product Oversight and Governance requirements coming into force on 1st October 2018, we would like to share with you hereby (i) an outline of the Product Approval Process applicable for new products as well as for significant modifications of existing products and (ii) the Target Market descriptions for the existing products open for sale.

Product approval process

Zurich Eurolife S.A. has well established product governance processes in place to oversee the design, approval and review of our products which meet the requirements of the Insurance Distribution Directive.

New product developments and significant modifications to existing products are subject to a formal product approval process which- Identifies the intended target market and their needs

- Tests products to assure they meet the needs of the target market

- Considers the degree of financial literacy of the target market

We also regularly review all of our products to identify if any changes are required and to ensure that they remain suitable for our target markets.

As a product manufacturer, Zurich Eurolife S.A. will continue to monitor its products to ensure that they meet the needs of customers and deliver fair value. However, should you ever consider that a product is failing to meet customers' needs or is potentially unclear then you can help us by providing feedback through your Zurich contact.

Target Market Description

As the product is unit-linked it is suitable for investors who are prepared to accept that there will be fluctuations in the value of the investment and that they may fall in value. The aim of the product is not to provide additional protection element (additional risk coverage) in addition to the value invested in the underlying investments, unless small ancillary risk coverage is required by regulatory rules in the country of the policyholder.

The product provides a range of investment options covering a wide spectrum of risk/reward profiles where investors are prepared to assess their suitability for themselves.

The product is not designed to meet any individual sustainability preferences. The product is not designed to actively promote sustainability characteristics or to have sustainable investment as its objective. Zurich does not provide any advice to customers on the choice of assets.